Pros and cons of cash cows

The article examines the pros and cons of cash cows. Businesses generally have a portfolio of several products and services; however, not all of them are the same in terms of revenue generation. Some of them are very successful, while others are not. Those that generate more revenue than they consume in resources are called cash cows.

Definition of cash cow

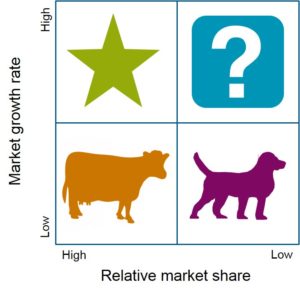

‘Cash cow’ is a key element in the four celled growth matrix developed by Bruce Henderson/Boston Consulting Group (BCG). This matrix focuses on two key factors i.e. company competitiveness, and market attractiveness—with relative market share and growth rate as the underlying drivers of these factors (BCG, 2023). Cash cows are those products/services that have high market share, but in low marker growth.

The concept of cash cow is derived from the farming reference where a dairy cow produces milk over its lifetime, significantly more than the cost of its maintenance. The analogy perfectly fits in the business context, where a cash cow is a profit-generating product/service/unit that is self-sustaining, requiring little to no investment to maintain its profitable status.

According to Moadel (2022) a cash cow is a venture or operation that provides steady, reliable income or other benefits with minimal maintenance or oversight. In essence, it is the golden goose of a company, consistently laying golden eggs in the form of revenue and profits.

Understanding the cash cow concept is crucial because it helps companies strategically direct resources and efforts. It provides a clear perspective on which product or business units are generating substantial profits and which are not. This understanding is important for strategic planning and decision-making processes within the organization.

Characteristics of a cash cow (Cash cows in BCG Matrix)

High market share

Cash cows have high market share. For instance, iPod was a cash for Apple Inc. as it had high market share.

Low growth rate

Cash cows have a low growth rate. Since they are mature products/business units, they have already passed the growth phase and have reached their peak. This does not mean they are less valuable; instead, their value lies in their consistent and reliable profitability.

Pros of cash cows

Steady streams of revenue

Cash cows play a pivotal role in the business ecosystem. They serve as the financial bedrock of a company, providing a steady stream of revenue and profits. This financial stability allows the company to invest in other areas such as research and development, marketing, and expansion into new markets.

Attractive to investors

A successful cash cow can significantly increase a company’s market valuation, making it more attractive to investors. This can lead to increased investment, further driving growth and profitability.

Company safety net

In times of economic downturn or when other business units are underperforming, the steady revenue from the cash cows can help to keep the company afloat. This provides it with the financial stability to weather challenging times and ensure long-term survival.

Maturity

Cash cows are often mature products or business units. They have been in the market for a considerable period and have established a loyal customer base. This stability and predictability make them less risky compared to newer products or business units.

Cons of cash cows

Over reliance on a product/service/unit

One of the main cons of cash cows is the over reliance on a single product or business unit for most of the company’s profits. If the cash cow’s performance declines, it can significantly impact the company’s financial health.

Complacency

Another risk is complacency. As cash cows generate consistent profits, companies may neglect to innovate or diversify their product portfolio. This can leave them vulnerable to changes in market trends or customer preferences.

Maintenance challenge

Managing a cash cow can also be challenging. Companies need to balance maintaining its profitability with investing in new growth opportunities. This requires careful strategic planning and resource allocation.

How to identify cash cows?

Identifying cash cows in a business requires a thorough analysis of the company’s product portfolio. This involves assessing each product or business unit’s profitability, market share, growth rate, and competition.

Highly profitable products with a large market share and low growth rate are typically cash cows. These products have a loyal customer base and face little competition, allowing them to generate significant profits with minimal investment.

Firstly, analysts need to find out the market share of a product. They also need to know the market growth rate of the product. If the product has high market share and in a low growth market, it is a cash cow. It is worth noting that information for market share and growth are available on reliable e-sources such as Statista, Kantar, and international newspapers.

However, it is important to note that not all profitable products are cash cows. Some may require substantial investment to maintain their market position, making them less profitable in the long run. Therefore, it is crucial to consider the cost of maintaining the product or business unit when identifying cash cows.

Examples of cash cows

Product/service as a cash cow

For a company, a product or a range of products could be making the highest levels of revenue. In this case, that product or service is a cash cow.

One of the best examples of cash cows is Google search engine. It is Alphabet’s (Google’s parent company) search engine. It has 83.49% global search engine market share which is extremely high (Statista, 2023). Likewise, it is in a low growth market as many people are now prefer social media and AI to search engines.

Company as a cash cow

To understand the competitive position of a company, it can compare itself with others in terms of market share. Especially, diversified companies have many different types of businesses, and not all of them generate significant money for them.

A cash cow company is very mature and operates in a slow growth market. It is dominant in the market and requires little additional effort. As the market growth is slow, newcomers are unwilling to enter the market leaving the cash cow unchallenged. Coca-Cola and Visa are two good examples of cash cows. They are dominant players in their global market.

Person as a cash cow

An individual can also be regarded a cash cow for a company. It is often seen in the global entertainment industry. For example, Elvis Presley was often viewed as a cash cow to his manager, Colonel Tom Parker (Moadel, 2022).

Strategies for maximising cash cows

Maximising the profitability of cash cows can be achieved through various strategies, including cost reduction, price optimisation, and customer retention.

Cost reduction

Reducing costs can significantly increase the profitability of a cash cow. Since these products or business units already have a strong market position, companies can focus on optimising operations and reducing unnecessary costs.

Price optimisation

Price optimisation is another effective strategy. As cash cows have a loyal customer base and low competition, companies can potentially increase prices without significantly impacting demand.

Customer retention

Customer retention is crucial for maintaining the profitability of a cash cow. Companies should focus on keeping their customers satisfied and loyal to ensure consistent revenue.

Innovation

Companies should also invest in innovation to keep the cash cow relevant in the changing market landscape. This could involve updating the product or service, exploring new market segments, or improving operational efficiency.

Conclusion: Pros and cons of cash cows

The cash cow concept is a valuable tool for strategic planning and decision-making in business. By identifying and maximising their cash cows, companies can drive profitability, mitigate risks, and secure their financial future. However, managing cash cows requires careful planning, execution, and continuous monitoring to ensure their long-term sustainability.

Hope you like this article: Pros and cons of cash cows? You may also like:

BCG matrix – definition and how to use BCG matrix

Last update: 11 September 2023

References:

BCG (2023) What is the growth share matrix, available at: https://www.bcg.com/about/overview/our-history/growth-share-matrix (accessed 07 September 2023)

Moadel, D. (2022) What is a cash cow, available at: https://money.usnews.com/investing/term/cash-cow (accessed 07 September 2023)

Statista (2023) Market share of leading desktop search engines worldwide, available at: https://www.statista.com/statistics/216573/worldwide-market-share-of-search-engines/ (accessed 10 September 2023)

Author: M Rahman

M Rahman writes extensively online and offline with an emphasis on business management, marketing, and tourism. He is a lecturer in Management and Marketing. He holds an MSc in Tourism & Hospitality from the University of Sunderland. Also, graduated from Leeds Metropolitan University with a BA in Business & Management Studies and completed a DTLLS (Diploma in Teaching in the Life-Long Learning Sector) from London South Bank University.